The Potential of HubSpot for Manufacturing | An Ultimate Guide

Discover how HubSpot for manufacturing firms can supercharge your ROI. Explore real-world examples and limitations for manufacturing firms using...

Explore the potential of HubSpot for financial services in our complete guide. Explore use cases and limitations of HubSpot in the financial services sector.

The intersection of technology and client relations plays a key role in achieving sustainable growth in this rapidly evolving landscape of financial services. Financial services companies are seeking versatile customer relationship management (CRM) platforms. HubSpot has emerged as a game changer for financial service providers and offers tailored solutions to enhance client interactions and drive growth.

Financial Services firms have unique needs and regulatory considerations therefore, it is important to understand whether or not HubSpot is capable of handling the intricacies of the financial sector.

Let's shed light on the features a financial service provider looks for in a CRM and know their availability in HubSpot.

| Features Essential for Financial Services Company | Availability in HubSpot? |

| Campaign Management |

✔️ |

| Segmentation | ✔️ |

| Marketing Automation | ✔️ |

| Automated Email | ✔️ |

| Social Media Integration | ✔️ |

| Lead Scoring | ✔️ |

| Multi-Channel Communication | ✔️ |

| Customer Segmentation | ✔️ |

| Personalization | ✔️ |

| A/B Testing | ✔️ |

| Landing Page Creation | ✔️ |

| Drip Marketing Campaigns | ✔️ |

| Content Management | ✔️ |

| Contact and Account Management | ✔️ |

| Opportunity Management | ✔️ |

| Sales Pipeline Tracking | ✔️ |

| Sales Forecasting | ✔️ |

| Sales Automation | ✔️ |

| Lead Routing | ✔️ |

| Contact History Tracking | ✔️ |

| Cross-Selling and Upselling | ✔️ |

| Referral Tracking | ✔️ |

| Client Onboarding | ✔️ |

| Performance Metrics | ✔️ |

| Integration with Financial Tools | ✔️ |

| Document Management | ✔️ |

| Mobile Sales Tools | ✔️ |

| Product Catalog Management | ✔️ |

| Quote and Proposal Generation | ✔️ |

| Order Management | ✔️ |

| Contract Management | ✔️ |

| Lead Management | ✔️ |

| Customer Support Ticketing | ✔️ |

| Case Management | ✔️ |

| Knowledge Base | ✔️ |

| Self-Service Portals | ✔️ |

| Service Level Agreements (SLAs) | ✔️ |

| Customer Feedback and Surveys | ✔️ |

| Integration with Support Channels (e.g., email, chat, phone) | ✔️ |

| Complaint Management | ✔️ |

| Escalation Management | ✔️ |

| Service Analytics and Reporting | ✔️ |

| Service Workflow Automation | ✔️ |

| Service Request Management | ✔️ |

| Client Data Enrichment | ✔️ |

| Service Knowledge Management | ✔️ |

| Service Routing and Assignment | ✔️ |

| Contact and Client Information Management | ✔️ |

| Interaction History Tracking | ✔️ |

| Calendar and Task Management | ✔️ |

| Communication Log | ✔️ |

| Integration with External Data Sources | ✔️ |

| Customization and Personalization | ✔️ |

| Role-Based Access Control | ✔️ |

| Mobile Access | ✔️ |

| Workflow Automation | ✔️ |

| Compliance and Security Features | Limited |

| Integration with Other Systems (e.g., portfolio management) | Limited |

| Reporting and Dashboards | ✔️ |

| Data Analytics and Insights | ✔️ |

| Client Segmentation | ✔️ |

| Performance Metrics | ✔️ |

| Client Portal | ✔️ |

| Client Lifecycle Management | ✔️ |

| Client Data Migration | ✔️ |

| Data Import and Export Tools | ✔️ |

| Analytics and Reporting | ✔️ |

| Investment Portfolio Management | ❌ |

| Audit Trail for Data Changes | ❌ |

| Real-time Market Data Integration | ❌ |

For the most part, HubSpot aligns with the crucial requirements of financial services companies. The wide range of HubSpot features proves essential not only for enhancing operational efficiency but fostering sustainable growth within the sector. HubSpot and financial services providers have strong compatibility covering a variety of functionalities tailored to the specific needs of financial institutions. However, it's worth noting that there may be some features where exceptions apply to this general rule.

If the financial services companies want to fully optimize the benefits of HubSpot, they are recommended to establish integration objectives. In case of encountering any feature gaps, the financial service provider can consult with a HubSpot expert. So, they can help in assessing the feasibility of workarounds or providing valuable alternative solutions. That’s how financial services companies can ensure a seamless and thriving integration of HubSpot whether it's driving sustainable growth or streamlining client relations.

Financial services companies experience a considerable transformation with the integration of technology-driven solutions as they reshape the way financial businesses operate. HubSpot, a growth-focused platform, has gained recognition for its vast suite of hubs designed to meet the crucial operational needs of financial services companies. It’s renowned for addressing the distinctive requirements of financial service providers.

HubSpot helps financial services companies to enhance their marketing strategies more effectively. It offers useful marketing automation tools so that financial institutions can craft personalized client journeys, starting from the initial interaction to post-service follow-ups. Following are some important marketing automation tools that a Financial Service Company might use.

With automated email marketing, financial services can create targeted email campaigns to nurture leads, provide valuable financial insights, and deliver timely updates. Moreover, it also helps in enhancing engagement and trust by ensuring that clients receive relevant content at the right time.

For example, a financial service provider can leverage automated email marketing to enhance customer engagement and promote new investment opportunities. By analyzing customer transaction patterns and preferences, the system sends personalized emails with tailored investment recommendations, timely market updates, and exclusive promotions. This ensures proactive communication, fosters trust, and drives increased client participation in financial offerings.

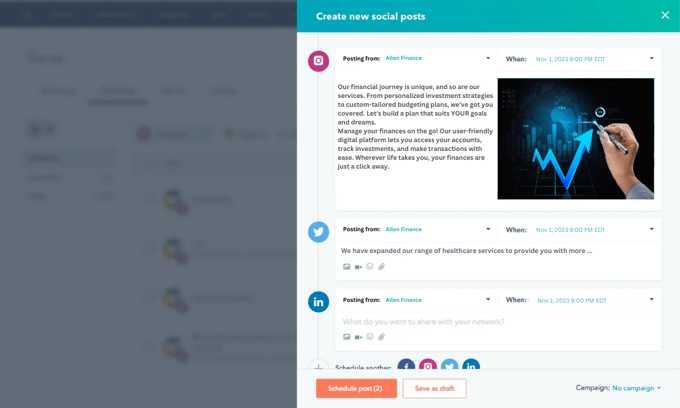

Social media tools enhance client engagement, boost visibility, and establish a compelling online brand presence. Additionally, HubSpot's analytics capabilities empower financial companies to measure campaign performance, track metrics such as click-through rates and audience demographics, and make data-driven refinements for future strategies.

For example, a wealth management firm can strategically share tailored investment guides, market trends, and retirement planning tips across platforms like LinkedIn and Facebook. HubSpot's analytics tools will also enable the team to measure the reach and engagement of these content pieces, allowing for data-driven adjustments.

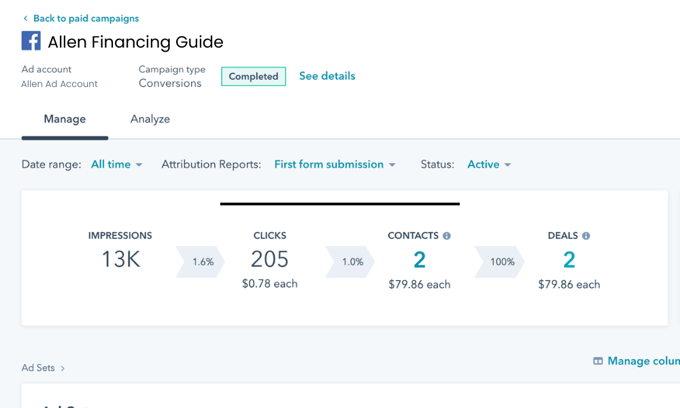

With HubSpot's campaign management feature, financial service providers can plan, execute, and analyze marketing campaigns with precision. They can strategically plan campaigns and measure their success against the objectives set whether it's launching a product promotion or targeting outreach efforts.

For instance, a fintech startup can maximize its marketing impact with HubSpot's Campaign Management feature. The platform allows the company to seamlessly plan, execute, and track multi-channel campaigns. HubSpot's centralized dashboard streamlines campaign monitoring, providing real-time insights into lead acquisition, conversion rates, and customer engagement. This holistic approach enables the fintech startup to optimize its marketing strategy, drive app downloads, and cultivate a loyal user base.

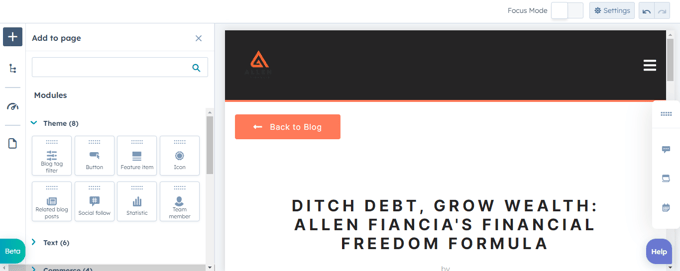

By using the blog builder feature in HubSpot, financial service providers can establish themselves as industry experts. By creating and publishing insightful content on financial trends, regulatory change, and investment strategies, companies may enhance their thought leadership. Blogs help attract new clients and nurture existing relationships when shared across various channels.

For example, a digital banking platform can leverage HubSpot's Blog Builder to craft targeted content, including blog posts on topics such as "Smart Budgeting for Millennials," "Navigating Cryptocurrency Investments Safely," and "The Future of Contactless Banking." The platform's SEO tools ensure these posts rank high in relevant searches, driving organic traffic. With analytics, the marketing team tracks the performance of each post, refining their strategy to produce more content that resonates with the audience and positions the platform as a go-to resource for modern financial insights.

For client acquisition and retention, financial service providers should maintain efficient sales processes. Let’s dive deep into the key features of HubSpot Sales Hub that are tailored to meet the unique needs of financial services companies. These features are specifically designed to enhance appointment scheduling, lead management, pipeline visibility, and quotes and proposal generation.

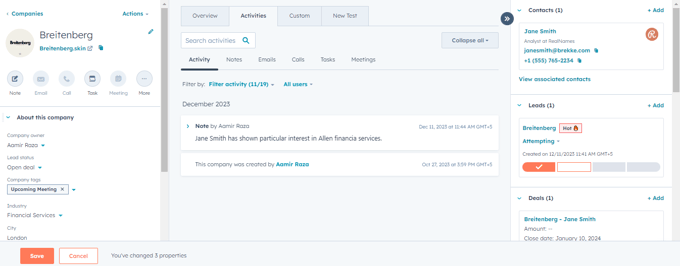

HubSpot Sales Hub empowers financial service providers with robust lead management tools, presenting a comprehensive view of prospective clients. This feature provides detailed lead profiles consisting of preferences, interactions, and engagement history leading to help sales teams to tailor their approach, promoting meaningful connections.

For example, a financial advisory firm can efficiently capture leads from website consultations and social media interactions, categorizing them based on financial preferences like investment goals and risk tolerance with HubSpot's predictive lead scoring feature. Automated workflows nurture leads through personalized email campaigns, delivering tailored content on topics such as retirement planning and investment strategies. With detailed lead analytics, the firm identifies high-value prospects, optimizing its approach to client engagement and ultimately enhancing the conversion of leads into long-term clients.

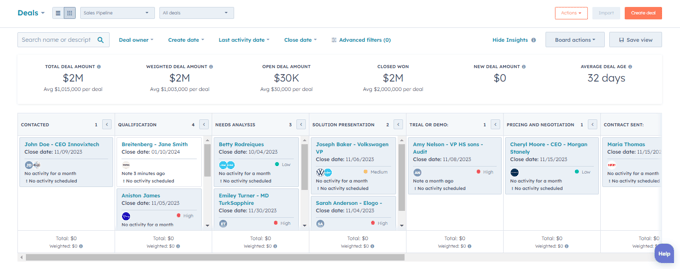

Financial service providers should have effective pipeline management to ensure accountability and transparency throughout the sales process. HubSpot’s intuitive tools manage and monitor the sales pipeline and allow sales teams to identify bottlenecks, track deals, and streamline workflows for optimal efficiency.

HubSpot offers customization of pipeline stages by recognizing the unique workflows of financial services companies. Financial service providers can ensure that every deal is progressing seamlessly through the pipeline by aligning these stages with their specific sales processes.

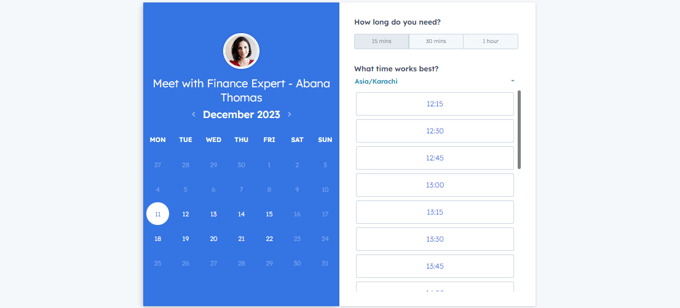

HubSpot's appointment scheduling feature empowers financial service providers by allowing clients to conveniently schedule appointments, minimizing engagement conflicts. The integration with calendar tools ensures efficient management, preventing scheduling conflicts. Automated reminder notifications enhance the client experience, promoting preparedness and professionalism for both sales representatives and clients during meetings.

For example, let's say Sarah's financial advisory firm leverages HubSpot's appointment scheduling feature to facilitate seamless client interactions. John, a client approaching retirement, navigates to the website, selects a suitable time for a consultation, and receives automated confirmation and reminder notifications. The integration with Sarah's calendar ensures efficient time management, reducing scheduling conflicts. This tool enhances the client experience, allowing for well-prepared and punctual meetings focused on tailored retirement planning strategies.

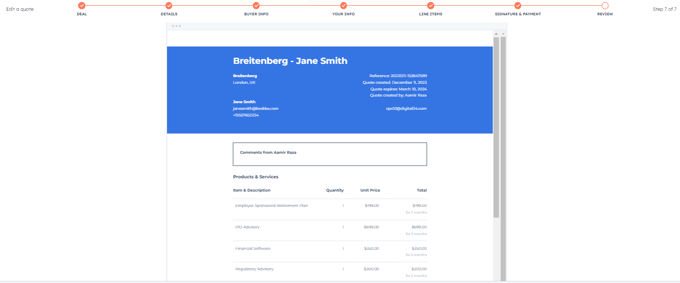

HubSpot Sales Hub optimizes the Quotes generation process for financial service providers, allowing them to create tailored, professional documents efficiently. The intuitive tools accelerate the sales cycle and improve the client experience. HubSpot's version tracking and collaboration features ensure seamless revisions, fostering effective communication between sales teams and clients to align documents accurately with financial objectives.

For example, a mortgage brokerage firm can employ HubSpot Sales Hub to expedite the quote generation process. Leveraging intuitive tools, loan officers create precise mortgage proposals for clients, incorporating personalized details such as interest rates and repayment options. The version tracking and collaboration features ensure seamless collaboration among the sales team, allowing for swift adjustments based on client feedback. This efficiency not only accelerates the proposal cycle but also strengthens client trust through transparent and tailored financial offerings.

In financial service companies, it's essential to provide exceptional client support to build trust, ensure satisfaction, and retain long-term relationships. Here are the key features of HubSpot Service Hub that empower financial service providers to revolutionize client support and promote satisfaction.

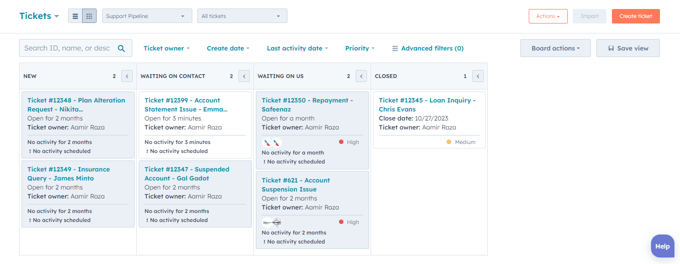

HubSpot's ticketing system enhances client query resolution for financial institutions by categorizing and prioritizing tickets, ensuring timely and reliable support. The system, integrated with client profiles, offers a comprehensive view of interactions, enabling support teams to deliver personalized and efficient responses with a contextual understanding of client history.

For example, a digital banking customer, Emma, encounters a discrepancy in her account statement and submits a ticket through the bank's HubSpot Ticketing System. The system categorizes the issue and prioritizes it for prompt attention. The integrated view of Emma's interactions and history allows the support team to quickly understand the context. They efficiently address her concern, providing a personalized resolution and ensuring a positive customer experience.

The knowledge base feature in HubSpot allows financial service companies to create a repository of informative content. By using this self-service, clients can access educational materials, find answers to common queries, and gain insights into financial products or services.

So, the clients can find solutions independently without the need for direct support which enhances the overall client experience. Financial service providers can easily manage and update the knowledge base to ensure that the available information is accurate and reflects the latest industry developments.

-png.png?width=680&height=442&name=How%20(1)-png.png)

Credits: HubSpot

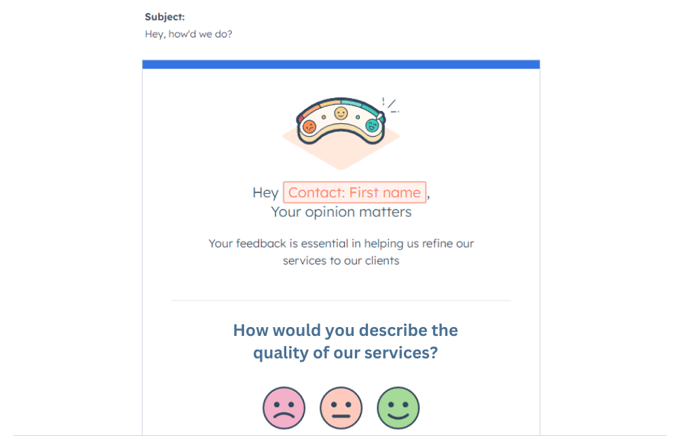

HubSpot's feedback surveys empower financial service companies to gather valuable insights directly from clients, enhancing service strategies. Integrated with service metrics, these surveys provide a comprehensive view of customer sentiment, enabling companies to identify areas for improvement and make data-driven decisions for optimizing support operations and enhancing overall client satisfaction.

For instance, a credit union leverages HubSpot's feedback surveys to enhance customer satisfaction. After a mortgage application process, clients receive a post-service survey to share their experience. The integrated feedback helps the credit union identify pain points and refine the application journey. By aligning survey insights with key performance indicators, the credit union strategically improves its mortgage services, resulting in increased customer satisfaction and a more streamlined application process.

HubSpot's live chat is a dynamic feature that enables real-time engagement between financial service providers and clients, offering instant assistance and enhancing the accessibility of support services. The integration with the ticketing system ensures that live chat inquiries are documented and tracked, contributing to a cohesive support ecosystem for future reference and analysis of client interactions.

Let's say, a client, James, encounters an issue while accessing his online banking portal and initiates a Live Chat with the financial service provider using HubSpot. The support team promptly assists James in real time, resolving his concerns and guiding him through the necessary steps. The Live Chat interaction seamlessly integrates with the Ticketing System, documenting James' inquiry for future reference. This not only ensures a responsive client experience but also contributes to the financial service provider's continuous improvement efforts by analyzing and addressing common user issues.

Credits: HubSpot

HubSpot provides a broad range of valuable features tailored for financial services companies. While there are numerous benefits financial service companies may have, it's imperative to acknowledge certain limitations. The two noteworthy limitations of HubSpot for Financial Services are mentioned below:

Financial services are subject to strict regulations that govern data security and privacy. HubSpot may not specifically address all the compliance requirements specific to the financial industry, potentially leading to challenges in meeting regulatory standards.

Financial service companies frequently entail intricate products, complex sales cycles, and a wide range of client needs. HubSpot's built-in features might not be strong enough to handle the complexities of selling financial products; additional functionality and customization using Custom Objects and CRM Development Tools tailored to the financial sector may be needed.

HubSpot stands as a powerful solution to revolutionize financial service companies by addressing their unique needs and fostering growth. Tailored tools and features cater to the distinctive requirements of financial organizations, presenting an opportunity to optimize client engagement, refine growth strategies, and streamline operational processes. While leveraging the extensive capabilities of HubSpot, financial service companies can explore additional solutions to address specific aspects of client interactions and drive growth.

Discover how HubSpot for manufacturing firms can supercharge your ROI. Explore real-world examples and limitations for manufacturing firms using...

Explore the potential of HubSpot for B2C to increase sales and growth. Discover compatibility, features, and real-world use cases for informed...

Discover how HubSpot for healthcare industry is driving patient growth and improving their experiences